Property and Casualty Exam Secrets: 5 Gems

Here are 5 property and casualty exam secrets that can’t be found in any insurance adjuster class, and will increase the likelihood of passing your exam on the first try.

Alright, my insurance warriors… Let’s Dive In! This article is going to help you pass your insurance claims adjusters exam covering property and casualty.

In every state, the language tends to be slightly different, but in most states, this is called the all-lines adjuster exam. So don’t be alarmed if the wording doesn’t align with your state because the material covered is the same.

You see… the first time I took the (Georgia) exam, I failed. It is embarrassing but true.

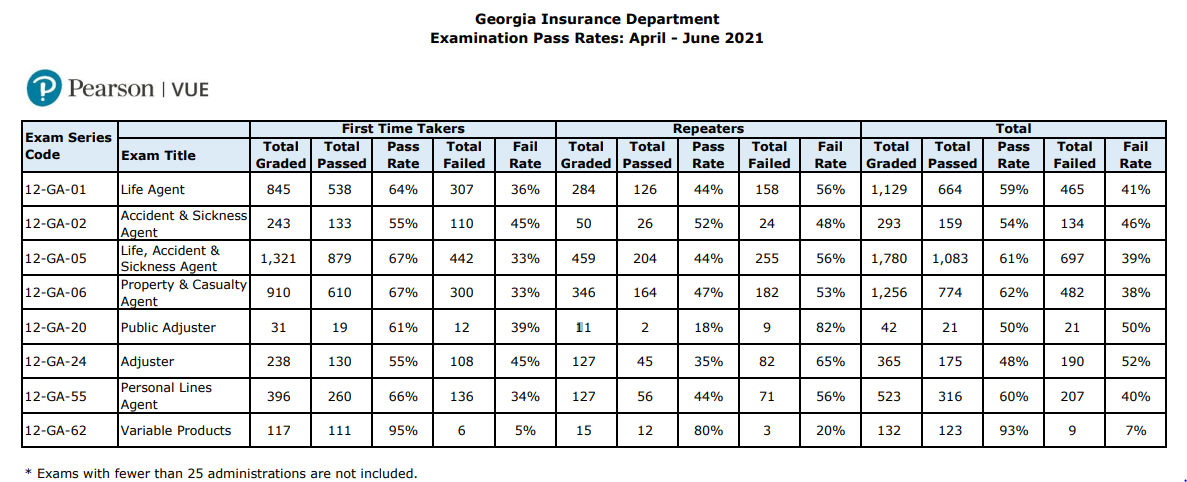

You may not know this but, 36% of first-time test takers fail the exam!

I hope that by writing this article I can save you money and time by not having to take the exam twice.

Don’t let it happen to you!

In the state of GA, you have to wait two weeks to retake the exam. Who wants to wait two weeks? However, in the state of Indiana, you can take it again that same day. (LUCKY HOOSIERS!)

I know you’re here to see the tips so let’s begin…

Property and Casualty Exam Tips

Tip #1: Practice Exam Questions

After you have reviewed all your test material I want you to take a week before you take the exam. Use this week to take as many practice questions as you can. Everyone needs practice, right?

My advice is to perform study sprints to prevent fatigue. This means taking breaks after every 20-minute session. Set a timer so that you are not constantly looking at the clock.

Next, after each 20-minute study session take a five-minute break in between walking around the house. Maybe watch a short video clip but get up away from the computer.

This is a recommendation that will help your brain refresh itself…

After the 5-minute break, come back to the questions. Each one that you get wrong I want you to ignore that answer so that you can focus on which ones are right.

When I was studying for the GA Adjuster exam, I noticed when taking practice questions if I got it wrong today, more than likely I got it wrong tomorrow because I didn’t focus on which one was the right answer.

DO NOT RUSH THROUGH Exam QUESTIONS

When I just rushed through the questions and if I got most of them right I was okay with that. But, that didn’t help me pass the exam. Go for 100% when you take practice exams.

Since I failed my exam the first time, I did something different the second time around when taking practice questions. I focused on the right answers.

I made sure that the ones I got wrong were practiced again 4-5 times. Sounds like a lot?[People who fail – do so by less than 3 points]

It’s not. Because I had to make sure it was right.

So remember, review the material and save a week before the adjuster exam to only take practice questions.

Good Places To Get Property & Casualty Exam Practice Questions

Here’s what I used… this video is great for explaining policies. It’s a long video so buckle in.

I watched it multiple times.

Another place to get questions is … use the questions from the provider of your Independent Adjuster Pre-Licensing Course. Try this:

- Go through the quizzes – just click pass the course material

- Answer the same set of questions 3-5 times in a row. If you get an answer wrong, start the set over.

- Give yourself time. 7-10 days.

- Try not to practice the night before.

- Get a good night’s rest before your exam (keep in mind test times are as early as 8 am)

That brings us to tip #2

Tip # 2: Take the insurance adjuster claims exam as early in the day as possible.

Why? Here’s something you may not have thought about….

You have so much other stuff going on during the day, and testing centers may not be located close to where you live or where you work. You don’t want to have to worry about traffic or other factors. Too many factors can get in the way.

In Georgia, test times were 8 am (check-in starts at 7:45 am) or 2 pm.

I know. 8 a.m. is early. But it is well worth it. Just wake up early, drive the distance, and get to your space.

BY THE Way, you cannot study in the examination facility while you are check-in in. You will go through a check-in process so don’t try to cram right before.

NOTE: Pick a Good Location

Pick a convenient location. I picked a location that was an hour away, on the other side of town, and in a place, I’d never been before until then. Do not do it!

Attempting to dash across town is not conducive to your success in passing the claims exam. Even if you select a later date, being close to your location will help you stay focused on passing.

TIP #3: Remember the differences between the following claims definitions

Here is a question that I remember getting on my exam … and I believe there were maybe three to four questions about aleatory or adhesion

Answer below…

So, before we answer this question let’s first define Aleatory. Aleatory – basically what happens when you pay for insurance and you need to make a claim.

For example, let us say the damage to your car is $3,000 you have a $500 deductible. You will be indemnified $2,500. This will take place even if you have insurance for your car for only two months the insurance company will still indemnify you for $2500.

Insurance companies don’t mind doing that because only a few people are going to make a claim. So, the majority …meaning everyone else who has an insurance policy with that company…is going to contribute to your $3000 claim.

Let’s discuss adhesion–

Now adhesion is when the insurance company makes the contract and the insurer decides to take

it or leave it. They lead you by the hand, down the road to wherever they want to

go. There is no negotiation. It’s a cookie-cutter policy.

It saves time. It saves money — everybody’s money.

So even though it is a bit of the farmer leading the mule, it is beneficial.

The answer to the question is a contract of adhesion. Try to remember that and get familiar with it. One is about equal balance – Aleatory. The other is a take it or leave it – Adhesion.

Tip #4:

My next tip is to teach it if that’s always been something in any subject that you learn if you want to learn it you teach it because you get to learn it twice.

So think about friends who have been in a recent accident. I had a friend who just had a hit and runs. He had witnesses and he was hit outside of his car but his uninsured motorist policy will take care of that.

But that’s not all,

You can also look into his grandparents’ homeowner’s insurance policy since he stays with them. Since he’s a relative their home insurance policy may cover him under the medical coverage. That might be something else that could help indemnify him from some of his medical bills.

Another way you can find to teach is to look into friends buying insurance… maybe they have a small business. They want to know if should they have theft protection and to what level should it just be scheduled.

With all that you are learning, you can give them advice.

You can also look at friends who are buying a home. They have to get some type of insurance but is all they need or should they get broad coverage too? You can lead them through to pick the right answer.

How close is the water home? Do they live in a flood plain?

WHAT ABOUT AUTO?

Most people can relate to auto insurance. Talk to your friends who may be high-risk insurers because they have many speeding tickets and they want to know what options they have. Talk to them about the different programs like the residual market that would help them get insurance because they have to have it. (ß the five words that make the insurance industry the best industry).

“I hate insurance!” I used to say that every unemployed month I worked. Especially, when ObamaCare started taking a penalty from my tax return. Ugh!

Like most people, you are not in love with your insurance, but you love it when you need it. #necessaryEvil.

This is what I say now, Being able to now hear what happens to drivers and provide help is the best feeling on earth. You’ll like it too!

Talk to friends about past insurance claims.

Everybody has some type of insurance or has just been in an accident. Listen and apply what are you learning by helping/teaching the insured (your friend).

Tip #5: Know what time insurance policies expire

These are two questions that I got from the exam both times that I took it so not just once but twice these questions came up each time I took the exam.

So I’ve seen these questions a total of 4 times. If you are taking the claims exam you might second-guess yourself. If I was sure, and I mean confidently sure, about those questions I would have passed.

OH how I would have saved time and saved money.

THIS VIDEO Answer and explains the answer.

Tip #6: Use in Real Life

Think about:

· The home that you have… do you have homeowners insurance?

· The credit cards in your wallet – what exactly does the insurance cover when you rent a car

· Did you know your homeowner’s coverage may also cover credit cards and the deductible is not applied?

· The business you want to own or start – will you use contractors? Will they need to be bonded? Licensed?

· The car that you have … Do you own a car and carry a liability-only policy? WATCH this scenario from Judge Judy 3mins (video)

· If something is stolen from you… Judge Judy’s case involves a theft insurance claim.

Do you have to carry WORKER’S COMP ON YOUR HOMEOWNERS POLICY?

In California, you must carry workers comp because you have people working in your home.

If someone gets hurts. you won’t have to pay out of pocket for that. #ThinkAboutLossWages. However, this instance is to protect the employees (or staff) that work at your home. If an incident occurred, insurance companies are more equipped to take care of the injured party’s needs.

Need a visual?

there’s a video I want you to YouTube

Summary of the episode: TITLE: Judge’s sister hits deer with her car. The driver (defendant) describes the impact with a deer. The driver didn’t know the car was NOT covered by full coverage (ska comprehensive insurance coverage). She doesn’t want to pay the full amount and the insurance company is not going to pay it because they don’t owe it.

it’s a good case to look at and to use for real-life situations.

Here is another important article that will help you better prepare for your exam. I am sure you have found this article helpful and you have learned something new that you have not learned in any insurance adjuster class.

2 thoughts on “5 (Quick & Easy) Property and Casualty Exam Secrets”

I’m vеry happy to uncover this website. I need to

tօ thank you for your time for this particularly wonderful read!!

I definitely loved every little bit of it and I also have you

saved as a favorite to look at new things on your bloɡ.

Thank you and its a pleasure