Top 10 Claims Adjuster Interview Questions & Answers

Before your trainee interview, become familiar with some claims adjuster interview questions and answers to

We Feel Your Pain… have no worries, we got you covered!

If you are not happy in your professional life, it might be a good time to consider becoming an insurance claims adjuster. With our online claims adjuster classes, you can earn your certification from the comfort of home.

We have 5 delightfully-different career paths you probably didn’t know existed. And best of all, job entry is straightforward and uncomplicated, we remove the headache so you can make a decision without all the noise.

Here’s How it Works (Steps You’ll Need to Take):

1. You’ll have to completely overhaul your resume. (I’m sure you know that)

2. You may have to get training to learn the business/job/industry. (your new employers will appreciate that)

3. You’ll have to invest time and energy (networking, cold calling, & cold emailing just to name a few)

4. Typically, you’ll have to start at entry-level or maybe even take a dreaded internship (you won’t have to do this with our options below)

5. You may have to start part-time or put in sweat equity to get your career going… but don’t panic!

While it will not be a walk in the park, we’ve put together a list of the best midlife career changes that have the easiest barrier to entry. Plus, they pay well. And, that’s what we really want, right?

It is very possible to find work from home positions even if you’re just getting started. Public adjusters can get started without a license and work where they want to – on the road or from home.

Independent and insurance adjusters can get started w/ no experience but will require a license.

It doesn’t matter if you want to be a field adjuster, desk adjuster, auto adjuster, property adjuster or beyond…

We recommend getting started by learning exactly what the requirements are for your state. Learn the legalities by completing a 40-hour claims adjuster pre license course.

If you have the skills and qualification in you to excel in this role? Then you’re good to go. If not, get started with gaining the skills, knowledge, and training to kick start your career.

Take the Job Search Challenge. Learn More –>

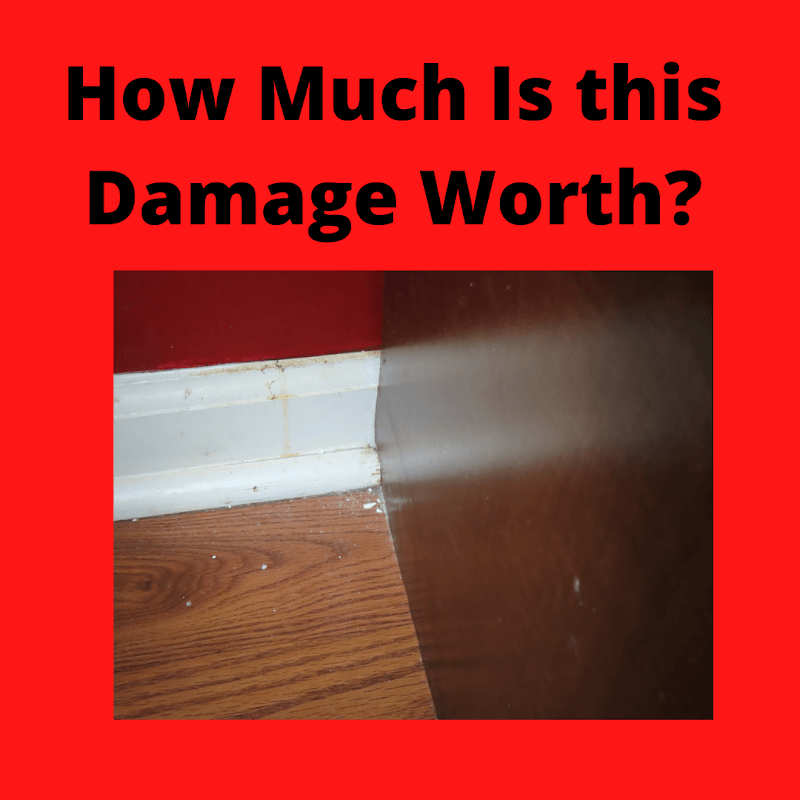

For example, a tree falls on your house, they’ll work with your insurance company to ensure the company is treating you fairly by taking care of all the costs. So, you have to pay next to nothing to restore your home. Here’s the best part, they don’t just work with homes.

Most people become familiar with adjusting after an auto accident but they handle so much more.

Adjusting can include a child choking on a toy to an athlete getting hurt at work. This is a very demanding field and has several opportunities wherever you go. From automotive to workers’ compensation. If it can be insured, it can be adjusted.

Here’s what to expect as an insurance adjuster:

After completing certification and obtaining a claims adjuster license, your task will be to decide on the insurance claim of any damage/loss and also the amount for the same. You get to work in different locations, and often on different sites. This is an intelligent and sizzling-hot active job that pay wells.

This video explains what an insurance adjuster does…

According to Bureau of Labor Statistics the median Pay is around $31.57 per hour. However, the adjusters who hustle and really work the business can earn over $100,000 per year.

Adjusters at Travelers start at $60,000/year and move to $80,000/year after training, and they typically work a couple claims a day.

Ok… to answer your question, insurance adjusters can make good money, but it’s totally up to the individual.

Here is a link to a video for the salary of insurance claim adjuster: Check out video here->

The simple answer is YES, and you can sign up for weekly job alerts to find companies hiring insurance adjusters today! Just click the image below or go here –>

We Feel Your Pain… have no worries, we got you covered!

If you are not happy in your professional life, it might be a good time to consider becoming an insurance claims adjuster. With our online claims adjuster classes, you can earn your certification from the comfort of home.

We have 5 delightfully-different career paths you probably didn’t know existed. And best of all, job entry is straightforward and uncomplicated, we remove the headache so you can make a decision without all the noise.

Here’s How it Works (Steps You’ll Need to Take):

1. You’ll have to completely overhaul your resume. (I’m sure you know that)

2. You may have to get training to learn the business/job/industry. (your new employers will appreciate that)

3. You’ll have to invest time and energy (networking, cold calling, & cold emailing just to name a few)

4. Typically, you’ll have to start at entry-level or maybe even take a dreaded internship (you won’t have to do this with our options below)

5. You may have to start part-time or put in sweat equity to get your career going… but don’t panic!

While it will not be a walk in the park, we’ve put together a list of the best midlife career changes that have the easiest barrier to entry. Plus, they pay well. And, that’s what we really want, right?

For example, a tree falls on your house, they’ll work with your insurance company to ensure the company is treating you fairly by taking care of all the costs. So, you have to pay next to nothing to restore your home. Here’s the best part, they don’t just work with homes.

Most people become familiar with adjusting after an auto accident but they handle so much more.

Adjusting can include a child choking on a toy to an athlete getting hurt at work. This is a very demanding field and has several opportunities wherever you go. From automotive to workers’ compensation. If it can be insured, it can be adjusted.

Here’s what to expect as an insurance adjuster:

After completing certification and obtaining a claims adjuster license, your task will be to decide on the insurance claim of any damage/loss and also the amount for the same. You get to work in different locations, and often on different sites. This is an intelligent and sizzling-hot active job that pay wells.

This video explains what an insurance adjuster does…

For example, a tree falls on your house, they’ll work with your insurance company to ensure the company is treating you fairly by taking care of all the costs. So, you have to pay next to nothing to restore your home. Here’s the best part, they don’t just work with homes.

Most people become familiar with adjusting after an auto accident but they handle so much more.

Adjusting can include a child choking on a toy to an athlete getting hurt at work. This is a very demanding field and has several opportunities wherever you go. From automotive to workers’ compensation. If it can be insured, it can be adjusted.

Here’s what to expect as an insurance adjuster:

After completing certification and obtaining a claims adjuster license, your task will be to decide on the insurance claim of any damage/loss and also the amount for the same. You get to work in different locations, and often on different sites. This is an intelligent and sizzling-hot active job that pay wells.

This video explains what an insurance adjuster does…

***All 3 require state-license & adjuster training.***

Before your trainee interview, become familiar with some claims adjuster interview questions and answers to